Motorbike insurance is an essential factor for peace of mind when traveling on Vietnam’s roads. But how can you save money while still ensuring maximum protection? In this article, Vietnammotorbiketour shares practical tips for buying motorbike insurance effectively — helping you choose the right plan that fits both your needs and your budget.

Why should you buy motorbike insurance in Vietnam?

Motorbike insurance is not only a legal requirement in many countries but also the best way to protect riders from risks while on the road. It helps cover part of the repair costs, medical bills, and other expenses arising from accidents or related incidents. Even in cases where motorbike insurance is not mandatory, it’s still highly recommended — because no one can predict unexpected situations that may happen while driving.

In reality, many people think that motorbike insurance is too expensive, but in fact, you can easily find affordable insurance plans if you know the smart tips shared below.

Take a motorbike safety course to reduce your insurance costs

One effective way to save on motorbike insurance costs is to take a motorbike safety course. Doing so not only helps you become a better and more confident rider but also shows insurance companies that you are a responsible, low-risk driver. As a result, they are more likely to offer you lower insurance premiums. Additionally, if you already have other types of insurance — such as home insurance or car insurance — it’s worth checking whether your current insurance provider offers discounts for motorbike insurance as part of a multi-policy package.

Compare insurance packages in detail before purchasing

When choosing motorbike insurance, you should compare the coverage details, not just the premium cost. Be sure to ask about:

- The maximum compensation amount you can receive in case of an incident.

- The deductible – the amount you must pay out of pocket before the insurance company covers the remaining costs.

Understanding these details will help you know your exact benefits and avoid any unexpected expenses later on.

Store your motorbike safely to lower insurance costs

Most insurance companies offer discounts if your motorbike is kept in a secure garage or storage area. This helps reduce the risk of accidents, vandalism, theft, or weather-related damage.

Note: Some insurance companies require you to use authorized repair services listed by them. If you choose to repair your motorbike elsewhere, you must inform the insurer in advance for inspection and approval.

Maintain a clean driving record

A clean driving record with no violations can help you receive better insurance rates when buying motorbike insurance. Insurance companies value riders with a safe driving history and a low risk profile. Make sure to keep all your insurance contracts and documents organized in an easily accessible place so you can present them whenever needed.

Regularly check and renew your insurance on time

Some insurance companies offer 6-month or 1-year policies. Make sure to contact your provider before the expiration date to avoid premium increases or interruptions in your coverage.

If you already have basic insurance, you may also consider adding rider coverage (personal accident insurance). This extended protection plan ensures you are covered in all situations where you may cause injury or damage to others.

Find online insurance deals

The internet is a great tool for comparing prices and finding an insurance plan that fits your budget. Many online insurance companies offer attractive promotions to stay competitive, while also providing a quick and transparent application process.

Insurance for all off-road motorbike tours in Vietnam

To ensure comprehensive insurance coverage while joining motorbike tours across Vietnam, you should have the following essential types of insurance:

- Personal Health Insurance

- Third-Party Liability Insurance

- Motorbike Insurance

Below is detailed information compiled by Vietnammotorbiketour about each type of insurance, the potential risks you may encounter, and how you can participate in off-road motorbike tours safely and legally in Vietnam.

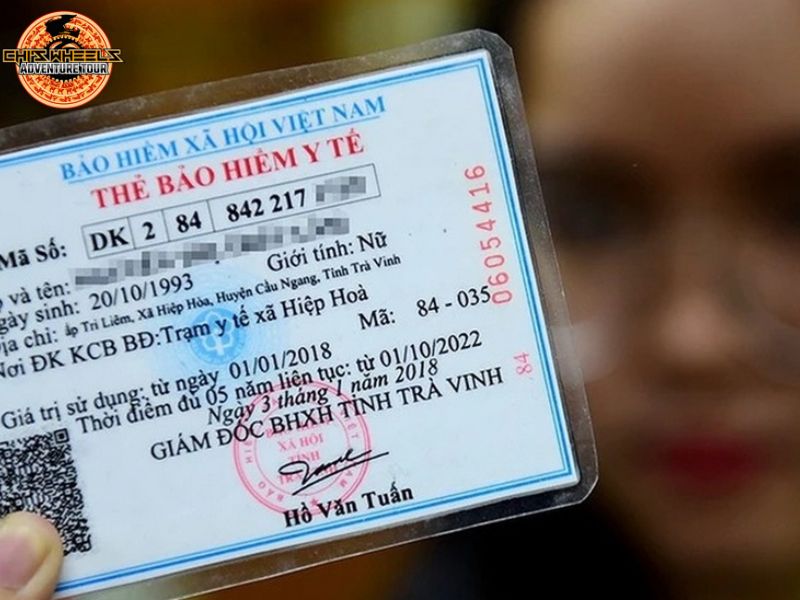

Personal health insurance

This is the most important type of insurance that Vietnammotorbiketour strongly recommends for all foreign travelers riding motorbikes in Vietnam. Personal health insurance protects you in case of accidents, injuries, or medical treatment needs during your trip.

If you are unable to obtain a local Vietnamese motorbike license while on a tourist visa, it is almost impossible to buy domestic motorbike insurance. To get a Vietnamese driving license, you would need a sponsoring company and must wait at least 7–10 days after arrival in Vietnam to complete the procedure — a process that is not practical for most short-term visitors.

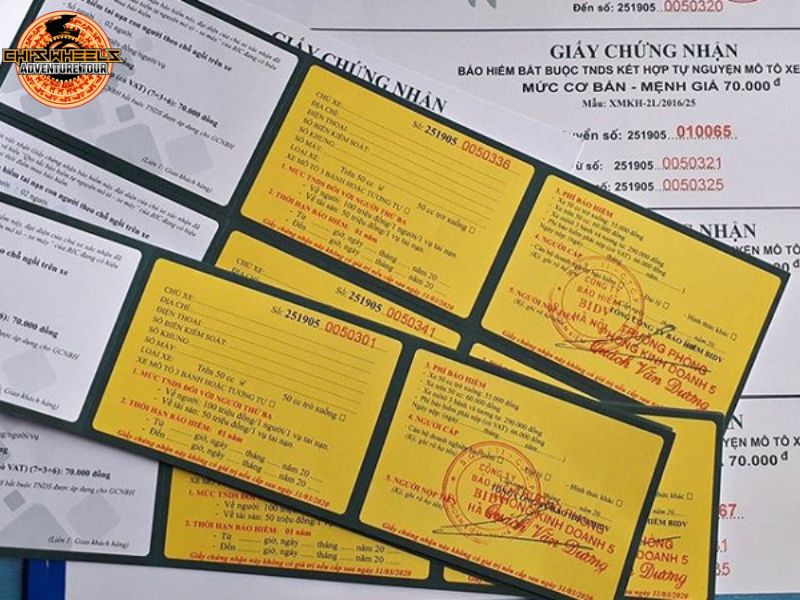

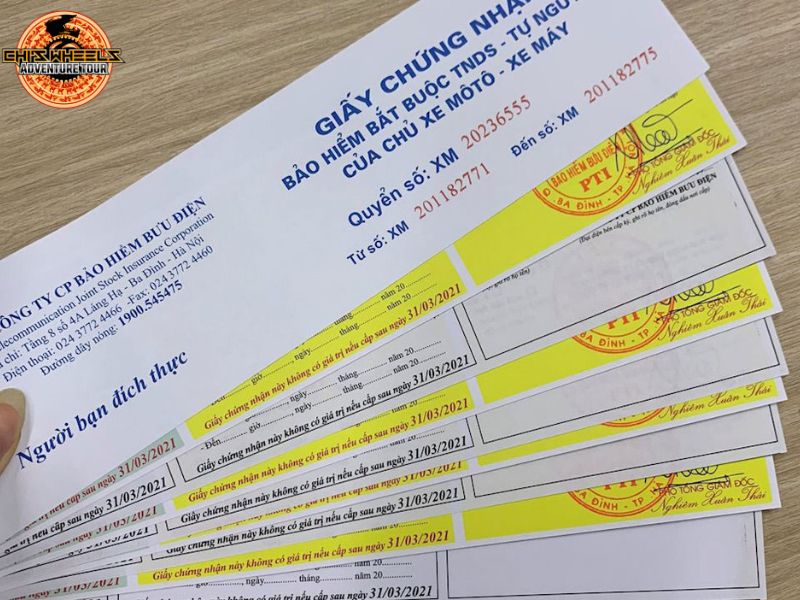

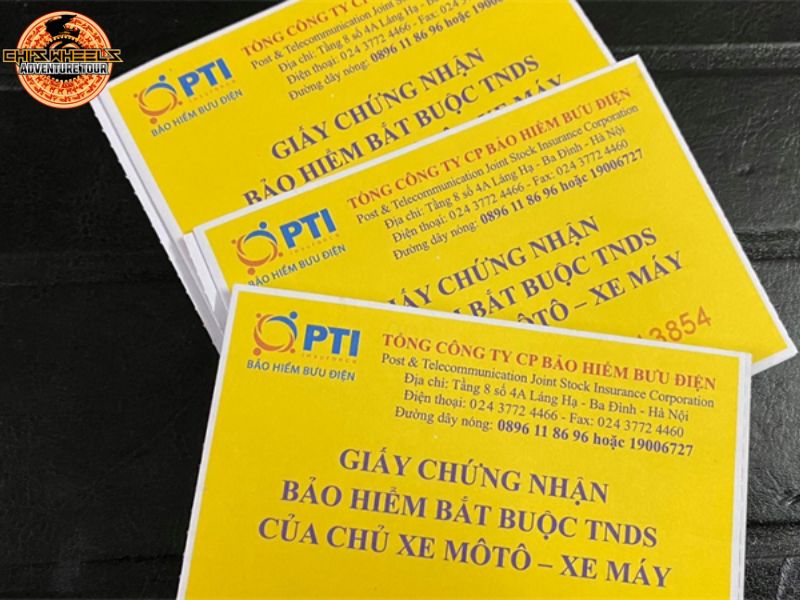

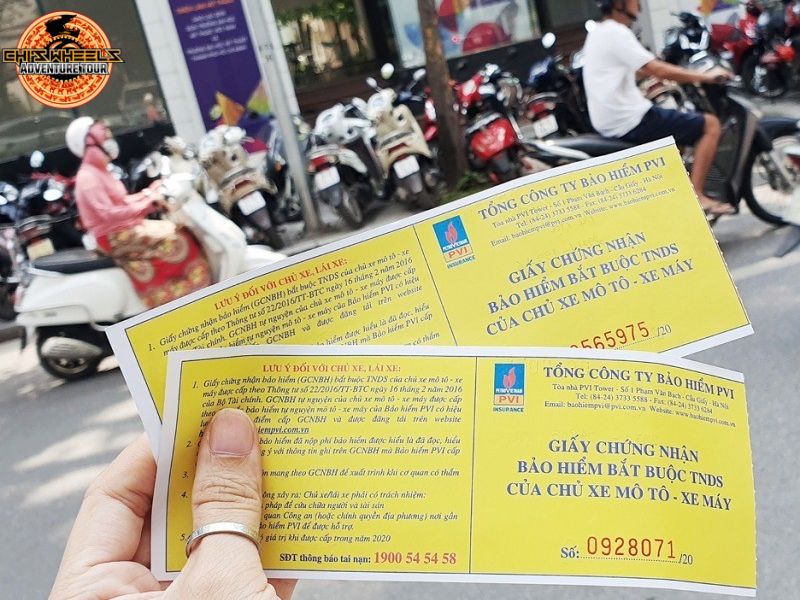

Third-Party liability insurance

Third-Party Liability Insurance (TPLI) is a type of insurance that covers injury or property damage to others if you are at fault in an accident. In Vietnam, this insurance is mandatory for all motorbikes operating on public roads.

The current premium rates are regulated by law and remain fixed according to vehicle type:

- Motorbikes under 50 cc or electric bikes: 55,000 VND/year

- Motorbikes over 50 cc: 60,000 VND/year

- Large-displacement motorbikes (over 175 cc) or three-wheeled motorbikes: 319,000 VND/year

This insurance provides compensation of up to 150 million VND per person per incident for bodily injury and 50 million VND per incident for property damage. However, to purchase this insurance, you must hold a valid Vietnamese motorbike license or a recognized International Driving Permit (IDP) issued under the 1968 Vienna Convention. This requirement makes it nearly impossible for short-term tourists to obtain this type of insurance on their own.

What to do in case of an accident

Third-Party Liability Insurance covers injury or property damage to others if you are responsible for an accident. The current premium rates in Vietnam are very low — 55,000 VND/year for motorbikes under 50 cc or electric bikes, 60,000 VND/year for motorbikes over 50 cc, and 319,000 VND/year for large-displacement bikes (over 175 cc) or three-wheeled motorbikes. This insurance provides compensation of up to 150 million VND per person per incident for bodily injury and 50 million VND per incident for property damage.

However, because the insurance premiums are quite low, local residents often prefer to settle compensation directly at the scene rather than filing a claim through the insurance company, in order to save time. If the case is reported to the police, the process may take longer and could lead to unnecessary legal complications.

Therefore, in the event of a collision, Vietnammotorbiketour guides will handle communication with the affected party to negotiate a reasonable compensation amount, helping you avoid dealing with local authorities directly. We strongly recommend allowing our team to represent you in such situations to ensure the matter is resolved safely, quickly, and effectively.

Purchasing motorbike insurance is not only about complying with the law but also about protecting yourself and others while traveling in Vietnam. With an affordable cost, you can easily obtain a comprehensive insurance plan that gives you peace of mind throughout your journey.

If you are a foreign tourist planning to join one of our off-road motorbike tours, Vietnammotorbiketour is ready to assist you in selecting the right insurance package, answering all your questions, and accompanying you on every route. Let us ensure your adventure in Vietnam is safe, complete, and free from legal worries.